Launched in 2020, the INVL Sustainable Timberland and Farmland Fund II (STAFF II) invests in forests and agricultural land in the Baltic region and Central and Eastern Europe, seeking to manage them sustainably with a long-term view.

The fund is registered in Luxembourg and is managed and administered by Apex Group, one of the largest providers of fund services in Europe. STAFF II operates under the laws of the Grand Duchy of Luxembourg, while the investment regulations the fund adheres to depend on where investments are made and vary by country.

Size of the fund.

Tonnes of carbon dioxide stored in the fund’s forest holdings*.

* Calculated for the portfolio as of 10.31.2024

STAFF II is a member of three international organisations.

The fund invests in the Baltic countries and Romania and intends to expand to the Central and Eastern European countries that belong to the European Union. Land value in this region has a higher growth potential than in Western Europe and the Nordic countries.

Both forests and arable land are managed in accordance with global sustainable management practices. The aim is to have a positive environmental, social and governance (ESG) impact on the countries we work in.

By investing in forest and agricultural land and applying sustainable management practices, the fund contributes to the EU-wide objectives of reducing carbon dioxide (CO2) emissions and achieving carbon neutrality.

The unlimited duration of the fund is at the core of a long-term sustainability strategy that contributes to the objective of preserving the Earth for future generations. One of the fund’s very specific goals is to preserve green islands of mosaic landscape and natural habitats for flora and fauna that may be designated or acquired along with other assets.

Our aim is to provide investors with stable long-term returns by developing a portfolio of forests and agricultural land located in European Union countries. We manage our portfolio in accordance with ESG principles and sustainable management practices, which creates value for both our investors and society in general.

We seek to become one of the European Union’s leading and most trusted funds in the field of sustainable alternative investments and simultaneously create opportunities for our investors to contribute to the preservation of nature for future generations.

Much of our attention is focused on sustainability and sustainable asset management. We combine current best market practices, expert assessment, national legal requirements, and global investment guidelines in the management of timberland and farmland we own.

Older Communications on Progress can be accessed here.

Forest and land are assets whose demand is growing while supply is limited and shrinking.

Forests are a renewable resource and a major carbon sink. They capture and sequester carbon dioxide throughout their lifetime, cleaning the air we breathe. Wood, besides its economic benefits, is an exceptionally valuable material that can be used for everything from construction to packaging. Therefore, forests contribute to economic development with sustainable renewable resources, which are a much more environmentally friendly alternative to plastic, cement, metal, and petroleum-based fuels.

Arable land is a limited and extremely important resource, whose significance is set to continue growing given the need to feed an ever-increasing human population. Agriculture is currently being rapidly transformed by the latest agricultural technology, which ensures that land is not degraded and its productivity increases.

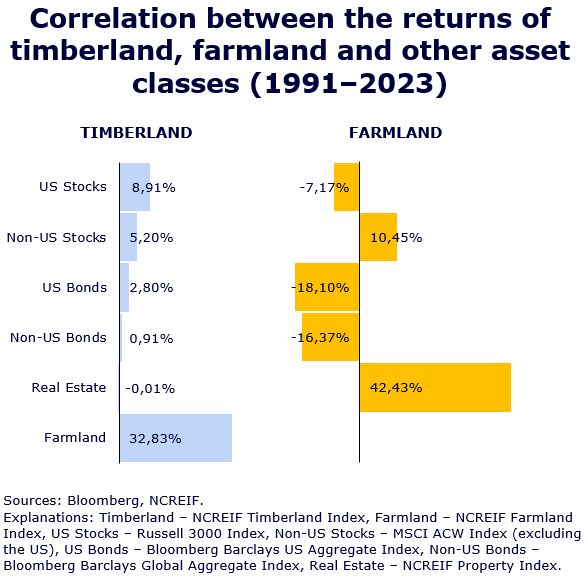

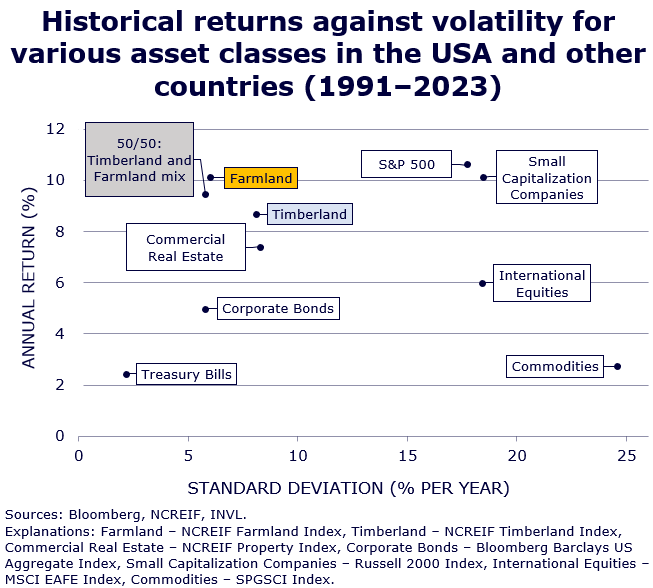

Investing in forests and farmland generates a stable return. Moreover, these asset classes have little or even negative correlation with traditional asset classes, and the correlation between forests and farmland themselves is also relatively low (NORSKOG, Department of Forestry and Environmental Resources, North Carolina State University, 2020).

This page provides only generalised information which is not adapted to the individual needs of any person. It is not and may not be construed as advertising or as information that offers, recommends or otherwise encourages acquiring forestry or agricultural land or becoming a participant of the collective investment undertaking referred to on the page or in any other way or form assuming the risks associated with acquiring, holding or selling such assets.

The information on this website concerning the characteristics of the assets of the collective investment undertaking or its investment holdings (including projections of investment returns) is based solely on the opinion of persons directly and/or indirectly involved in the management of that collective investment undertaking. In expressing that opinion, the persons are acting solely in their own interests and are not guided by nor take into account the interests or needs of any other person. Therefore, any person making any decision shall do so at his/her own risk and should, at his/her own discretion and expense, make use of experts in the relevant fields in order to be able to make a decision that is appropriate for his/her individual needs. That is the only way the person making the decision can mitigate the losses that are highly likely to occur (due to an investment in the collective investment undertaking and other assets mentioned on this website).

It should be noted that the past performance of a collective investment undertaking is only indicative of its performance in the past period. Past performance is no guarantee of future performance. If the return on an investment was positive in the past, it will not necessarily be so in the future, and the value of the investment may rise or fall. The persons directly and/or indirectly involved in the management of the collective investment undertaking referred to on this page do not guarantee the profitability of investments. Investors bear the entire risk of loss on their investments.

Before acquiring any assets mentioned on this page, you should, on your own or with the help of relevant experts, assess all the applicable fees and all the risks that investing entails and read all documents carefully.

Notwithstanding any other important information, you should always invest only money that you can afford to lose.